What Does Hsmb Advisory Llc Do?

Plan advantages are minimized by any type of impressive finance or loan interest and/or withdrawals. If the plan lapses, or is surrendered, any kind of superior car loans taken into consideration gain in the plan might be subject to average revenue tax obligations.

If the plan owner is under 59, any taxed withdrawal might likewise be subject to a 10% government tax penalty. All whole life insurance policy warranties are subject to the timely repayment of all required premiums and the cases paying capability of the issuing insurance coverage business.

The money abandonment value, finance value and fatality proceeds payable will be reduced by any type of lien outstanding as a result of the repayment of an increased advantage under this biker. The increased benefits in the initial year reflect deduction of an one-time $250 administrative cost, indexed at an inflation rate of 3% each year to the rate of acceleration.

How Hsmb Advisory Llc can Save You Time, Stress, and Money.

A Waiver of Premium motorcyclist forgoes the commitment for the insurance holder to pay further premiums ought to he or she end up being absolutely handicapped constantly for a minimum of 6 months. This cyclist will certainly sustain an added price. See plan agreement for added information and demands.

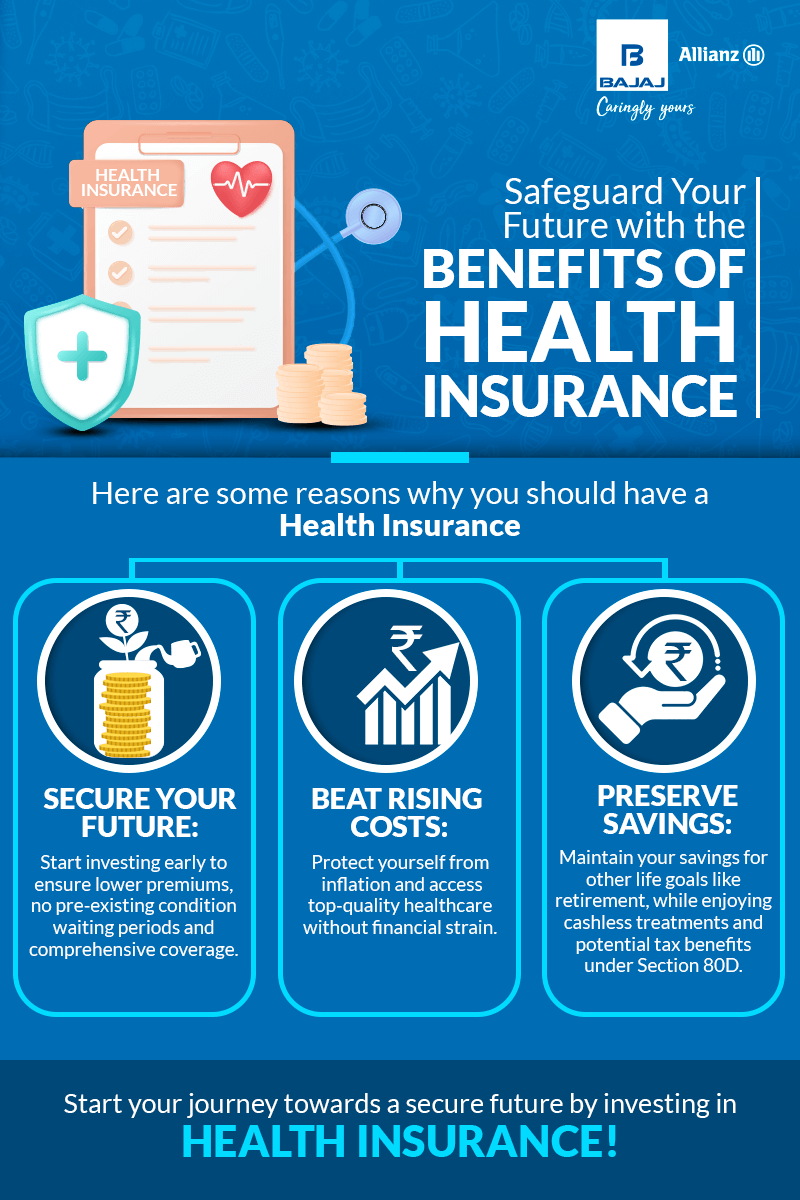

Right here are numerous cons of life insurance coverage: One negative aspect of life insurance policy is that the older you are, the extra you'll spend for a policy. This is because you're most likely to pass away during the plan duration than a more youthful insurance policy holder and will, in turn, set you back the life insurance firm even more money.

While this may be a plus, there's no guarantee of high returns. 2 If you choose an irreversible life plan, such as whole life insurance policy or variable life insurance policy, you'll receive long-lasting insurance coverage. The caveat, nonetheless, is that your costs will be greater. 2 If you want life insurance policy, take into consideration these ideas:3 Don't wait to look for a life insurance policy policy.

See This Report about Hsmb Advisory Llc

By applying for life insurance coverage, you'll be able to assist secure your enjoyed ones and gain some peace of mind. If you're uncertain of what kind of insurance coverage you must obtain, contact an agent to discuss your options.

There are numerous prospective benefits FL Health Insurance of life insurance policy yet it's typically the peace of mind it can provide that matters the most - https://www.giantbomb.com/profile/hsmbadvisory/. This is since a payout from life cover can serve as a monetary safety internet for your enjoyed ones to draw on ought to you pass away while your policy remains in area

The overriding advantage to all is that it can take away at least one concern from those you care about at a tough time. Life insurance policy can be established to cover a home mortgage, potentially assisting your family to remain in their home if you were to pass away. A payout can help your dependants change any kind of revenue deficiency really felt by the loss of your profits.

Hsmb Advisory Llc Can Be Fun For Anyone

Life cover can assist minimize if you have little in the way of savings. Life insurance products can be made use of as component of inheritance tax obligation planning in order to decrease or prevent this tax obligation.

You're with any luck eliminating some of the tension felt by those you leave. You have comfort that enjoyed ones have a particular degree of economic security to drop back on. Taking out life insurance policy to cover your home loan can provide assurance your mortgage will certainly be paid off, and your loved ones can proceed living where they've always lived, if you were to die.

Some Ideas on Hsmb Advisory Llc You Should Know

Impressive debts are normally repaid utilizing the worth of an estate, so if a life insurance policy payment can cover what you owe, there should be much more entrusted to pass on as an inheritance. According to Sunlife, the ordinary expense of a basic funeral in the UK in 2021 was simply over 4,000.

Some Known Details About Hsmb Advisory Llc

It's a considerable sum of money, but one which you can give your loved ones the chance to cover utilizing a life insurance policy payment. You must talk to your provider on information of just how and when payments are made to make certain the funds can be accessed in time to pay for a funeral service.

It might likewise provide you a lot more control over that gets the payout, and help decrease the chance that the funds could be used to repay financial debts, as can take place if the policy was outside of a count on. Some life insurance policy policies include an incurable ailment benefit choice at no added price, which might result in your policy paying early if you're detected as terminally sick.

An early repayment can allow you the opportunity to obtain your affairs in order and to maximize the moment you have actually left. Losing someone you love is difficult enough to manage by itself. If you can help reduce any kind of concerns that those you leave may have regarding how they'll deal financially moving on, they can concentrate on the important things that truly should matter at one of the most challenging of times.

:max_bytes(150000):strip_icc()/coordination-of-benefits-1850523021ff453f8f4f2e19a99324ea.png)